Wednesday, December 17, 2025

German Advertising Market Continues to Grow – ZAW Forecast Shows Slowing Momentum for 2025

The German Advertising Federation (ZAW) takes a cautiously optimistic view of the German advertising market for 2025. While growth is expected to continue, the latest year-end forecast reveals a noticeable loss of momentum, driven primarily by economic pressures and insufficient economic policy impulses.

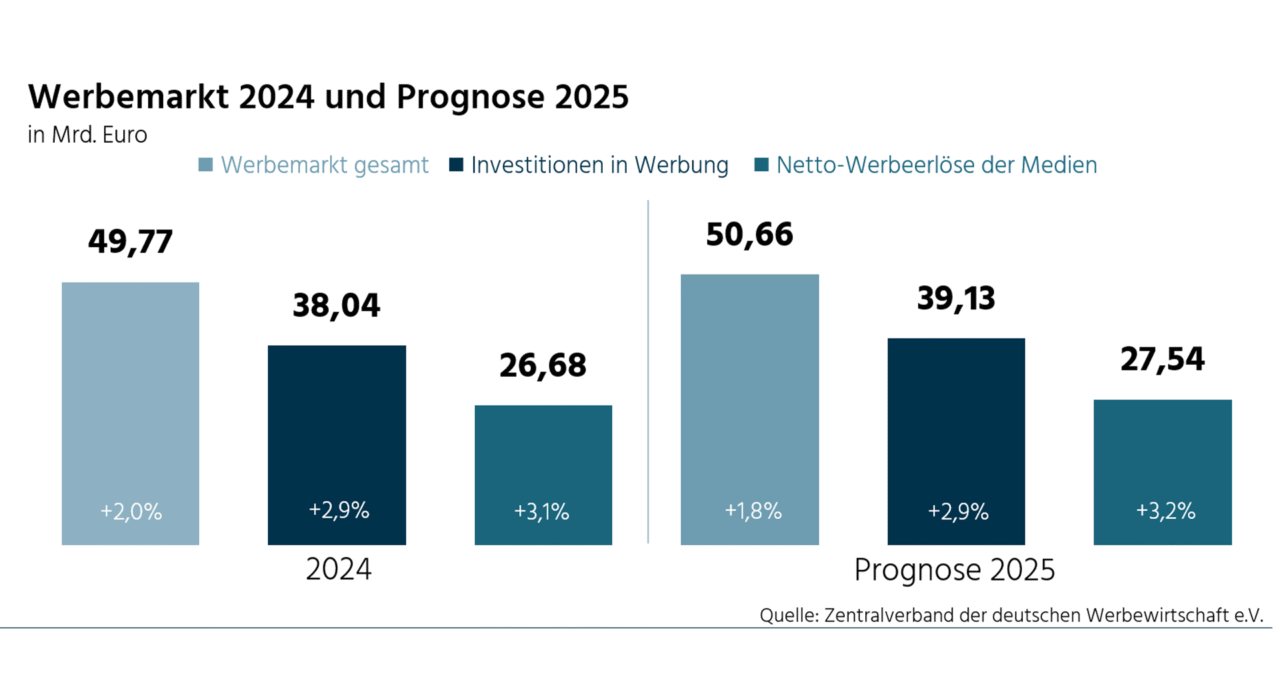

According to the ZAW, net advertising revenues are expected to reach approximately €27.5 billion in 2025, representing growth of 3.2 percent compared with the previous year. Once again, this places the advertising sector ahead of overall economic performance. Advertising investments are also projected to increase by 2.9 percent to around €39.1 billion. In total, the advertising market could therefore grow to approximately €50.7 billion, corresponding to a moderate increase of 1.8 percent. However, this forecast is contingent on a stable year-end business performance.

Other forms of advertising are expected to perform less favorably. The ZAW anticipates a decline of 1.8 percent to around €11.5 billion in this segment, highlighting the increasing structural divergence within the advertising market.

Digital advertising remains the key growth driver once again. As in previous years, a significant share of growth is concentrated among a small number of global platforms, while many other categories show only marginal growth or even contraction. This further reinforces the long-standing trend toward market concentration.

From the perspective of the advertising industry, the market continues to demonstrate resilience and fundamental robustness. At the same time, the impact of broader economic challenges is becoming increasingly evident. Weak economic prospects, subdued consumer sentiment, and ongoing political uncertainty are already influencing investment decisions. The year-end business period – particularly Black Friday and the Christmas season – remains critical, not only for 2025 results but also for advertising budgets in 2026.

ZAW President Andreas F. Schubert expresses clear concern: “Many macroeconomic and market-specific challenges remain unresolved. The shadows of overall economic development are increasingly affecting the advertising industry, creating growing uncertainty for 2026.”

These concerns are reinforced by the latest ZAW Trend Barometer, conducted at the end of October 2025. While the overall industry sentiment improved slightly from 3.2 to 3.4 points compared with spring, the broader picture remains subdued. Notably, the assessment of political framework conditions has stagnated at 3.0 points.

Looking ahead to 2025, the advertising industry largely expects a sideways movement. Most respondents anticipate stagnation rather than a meaningful upswing in the second half of the year. Political sentiment shows no sign of reversal either. On both national and European levels, economic policy attitudes toward the advertising industry are still widely perceived as strained.

More than half of respondents see no shift toward more trust-based regulation, less ideological intervention, and greater market orientation. On the contrary, many perceive an increase in dirigistic measures – particularly at the EU level. There is therefore no indication of a sustainable improvement in regulatory conditions.

Schubert once again calls for clearer and more reliable economic policy frameworks, pointing to key legislative initiatives at the European level, including the Digital Fairness Act and the Omnibus package on digital regulation. “We need regulation that supports innovation and enables data-driven business models. Without such an approach, sustainable and broad-based growth will not be achievable,” Schubert concludes.

The final, audited figures for 2025 will be published by the ZAW in spring 2026, together with the first forecast for 2026.